How does Venmo Work? Business Model and Revenue Streams

The era of carrying bulky wallets stuffed with various cards, receipts, and cash has completely faded. We’ve entered a new era of financial transactions, where the demand for contactless payments has skyrocketed. This shift from cash to digital payment options eventually has led to increased downloads for peer-to-peer (P2P) payment apps such as Venmo, Paytm, and Google Pay.

Today, our mobile phones have become the new wallet for us. According to Forbes, More than half (53%) of Americans use digital wallets more often than traditional payment methods. Moreover, it is expected that by 2026, the number of global digital wallet users will grow by 53% to reach 5.2 billion which is basically 60% of the global population.

The P2P payment market is estimated to garner $9,097.06 billion by 2030, which exhibits a high demand for apps that enable digital transactions. At present, the global market of P2P apps includes different business models, such as:

- Standalone Vendors like Venmo, Paypal, AliPay

- Bank Centric Services like Dwolla, Zelle

- Social Media Platforms like WhatsApp, Facebook Messenger

- Mobile OS Centric like Apple Pay, Android Pay

At Daffodil, we have been frequently interrogated about building a P2P payment app like Venmo. How much does it cost to build an app like Venmo? What’s the business model of Venmo? How does Venmo make money? These are some of the common inquiries that our expert team comes across.

To answer this query of the masses, we are here with this blog post that talks about Venmo, its roller-coaster ride over the years, its business model, ways to earn money, and so much more.

Venmo: Key Takeaways

Founders: Andrew Kortina, Iqram Magdon-Ismail

Launch date: August 2009 (March 2012 public launch)

Location: New York City, U.S.

Estimated Annual Revenue: $935 million (by 2022)

Industry: Finance

Business Type: Subsidiary

Parent Company: Paypal

Userbase: 85 million(2023)

- Over 2 million merchants accept Venmo in the US

- Venmo along with Paypal services allow users to purchase and use cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc.

- 60% of Venmo users are male and 40% are female

According to a February 2022 survey of online payment users in the United States, 32% of respondents stated that they had used Venmo in the past 12 months.

Venmo: Company Background

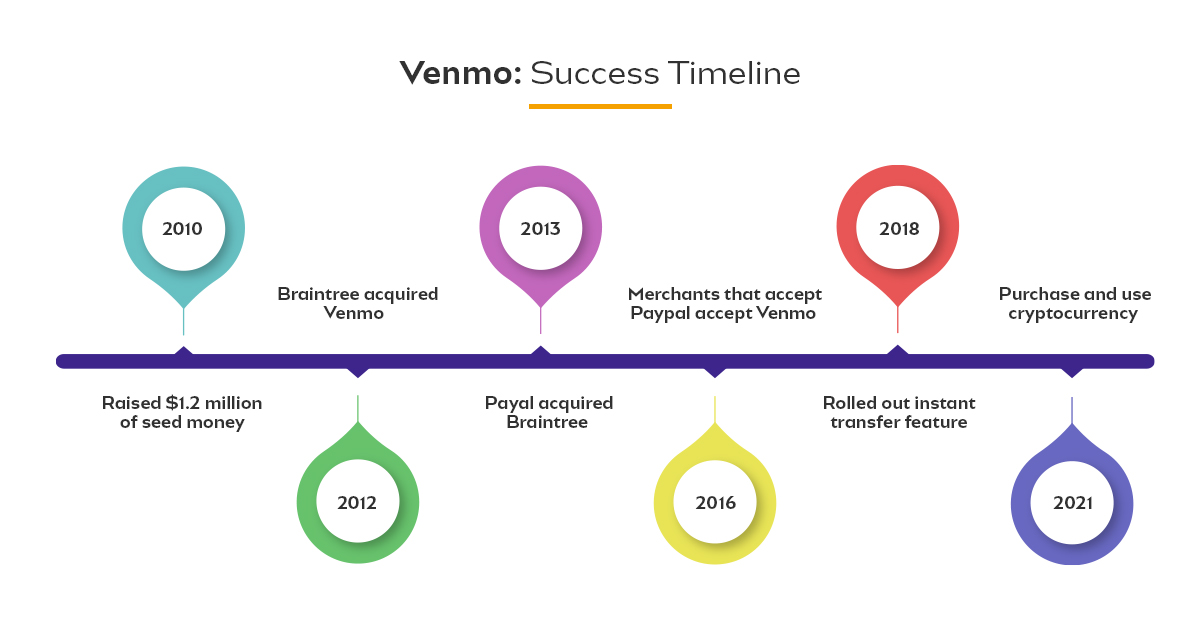

Venmo began in 2009 when Andrew Kortina and Iqram Magdon-Ismail teamed up. Originally in Philadelphia, they later moved to New York. They met at the University of Pennsylvania in 2001, both studying Computer Science, though Kortina switched to Creative Writing and Philosophy later.

During college, they started a company called My Campus Post, a site for students to post classifieds. Their journey led to the idea of Venmo when Magdon-Ismail visited Kortina in New York but forgot his wallet, prompting Kortina to cover the expenses.

They named it Venmo, a blend of ‘to sell’ in Latin and ‘mobile’, initially allowing payments via SMS. They added a social feed feature, allowing users to see friends’ transactions, and secured funding in 2010.

Credit: To the owner

Venmo was invite-only until 2012, refining the product before its public launch. Braintree acquired Venmo for $26.2 million, and then PayPal acquired Braintree, including Venmo, for $800 million in 2013.

Both founders left in 2014, and Mike Vaughan took over. Within PayPal’s ecosystem, Venmo expanded, introducing ‘Pay with Venmo’ in 2015, connecting with millions of merchants. Despite the growth, Venmo faced privacy concerns and misuse. A redesign and privacy settings update followed, aiming to address these issues.

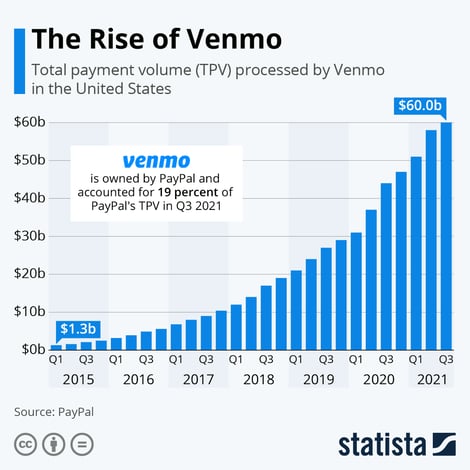

Venmo remains a significant peer-to-peer payment service in the U.S., processing close to $10 billion monthly. A partnership with Amazon in late 2021 further boosted its growth, allowing users to use Venmo for transactions on the platform.

How Venmo Works: Business Model

Despite strong competition, Venmo is rising high. The credit goes to some of its unique offerings. For example, unlike its competitors, Venmo does not charge anything for money transfers. However, for instant transfers, Venmo charges 3% of the total amount of the money is sent using a credit card.

- Venmo has gained popularity amongst millennials for offering one of a kind payment model, i.e. splitting the payment. The app users can split their rent, restaurant bills, etc. with one or more users and make payments.

- With Venmo, users can pay in stores, pay businesses, or pay in apps or online. Additional services that Venmo provides its users include a debit card and credit card. These cards can be used to make payments, earn cashback/rewards, purchase crypto, etc.

-

To use Venmo, both parties need the app and must connect with each other. The app looks a bit like Facebook Messenger and lets users chat and use emojis.

-

It’s important to know that Venmo is only for US residents with US bank accounts. Businesses can also sign up to accept Venmo payments by adjusting their PayPal Checkout settings. Some well-known partners include Uber, Grubhub, Lululemon, and Poshmark.

- For recurring payments, the Venmo app includes the ‘trust’ feature that allows users to autopay expenses that recur (say house rent)

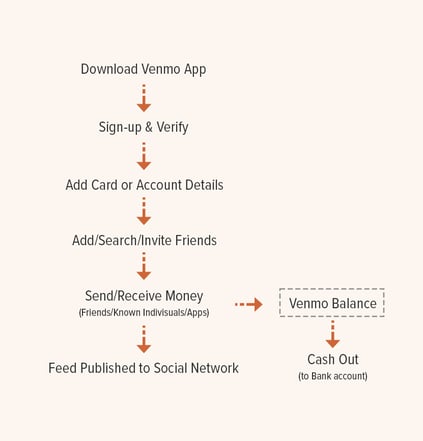

A user journey in the Venmo app is quite simple. The workflow shared below gives a basic overview of how Venmo works.

Venmo App Workflow

Source: Investopedia

How does Venmo Make Money?

Venmo’s revenue for the year 2021 is $900 billion (approx). How does this peer-to-peer payment app business make money? What are the revenue streams of Venmo?

There are different sources for Venmo to financially sustain itself. Pay with Venmo, Instant transfers, withdrawal fees, cryptocurrency transactions, etc. are some of them. Let’s talk about them in detail.

The Pay with Venmo feature allows users to purchase several merchant partners through their Venmo accounts. Whenever a user makes a purchase and pays at one of the merchants, Venmo gets 1.9% of the payment with $0.10 per transaction. This is one of the most popular revenue models in payment apps as it helps the buyer to choose from several modes to make the payment.

Instant transfers are another source of revenue for the Venmo app. A normal transaction through Venmo takes 3-4 days for processing and is free. Instant transfers, on the other hand, is a paid service by Venmo where a user is charged a 1.5% fee on the amount transferred. The minimum fee is $0.25 while the maximum fee is capped at $15.

Venmo makes money through Interchange and Withdrawl Fees. The P2P payment platform offers a debit card service (with Mastercard) to users that can be used for offline payments through Venmo balance. For the transactions made through cards, Venmo and Mastercard share the profit. When retrieving cash, customers are made to pay $2.50 ATM as a domestic withdrawal fee and $3.00 as an over-the-counter withdrawal fee.

Venmo makes money through cryptocurrency fees. The crypto fees are the margin between the market price that’s received from the trading service provider (Paxos) and the exchange rate between US dollars & crypt assets displayed to the users, along with the transaction fee for buying and selling cryptocurrency.

Introducing Venmo’s ‘Cash A Check‘ service, launched in January 2021, enabling users to conveniently cash pay or government stimulus checks. To utilize this feature, users must have location services enabled, opt for Direct Deposit or own a Venmo Debit Card, and have a verified email address.

To cash a check, users simply snap a photo of it for Venmo’s review. Upon approval, Venmo deposits the funds into the user’s account. The service incurs a 1% fee, with a minimum $5 cash-in requirement, and a 5% fee for non-payroll and non-government checks.

Additionally, Venmo offers cashback rewards on its credit card at select merchants, including Chevron, Papa Johns, Target, Dunkin’ Donuts, and more. Cashback programs refund a portion of the purchase price to the customer’s account, incentivizing patronage at these merchants. Venmo earns commissions from partners for referring customers, with the exact amount dependent on transaction volume and agreements with partners.

According to reports, Venmo holds a 38% market share, making it the second most widely used online payment method in the US.

Competitors of Venmo:

There are several electronic wallet services competing with Venmo for market share:

Google Pay: Similar to Venmo, Google Pay allows users to connect their bank accounts and cards. One advantage is its international availability.

Apple Pay: Growing in popularity, especially in the US and Canada, Apple Pay is also available internationally, with a focus on countries like the UK and Australia. It works across iOS devices and uses fingerprint scanning for transactions.

Zelle: Another cash payment app resembling Venmo, Zelle is owned and managed by a consortium of US banks.

Cash App: Created by Twitter’s founder, Jack Dorsey, Cash App offers free debit card transactions through its mobile app, aiming to rival PayPal.

ALSO READ: How Zelle Works? Business Model and Revenue Streams

Want to Build a P2P Payment App like Venmo?

Peer-to-Peer payment apps can make up a great business model but to compete with the solutions already there, it is important to overcome the limitations of the existing apps.

Venmo serves a unique purpose and has been a great hit amongst millennials in the U.S. To compete with an app like Venmo, it is important to work around the shortcomings in the existing app. For example,

- For Venmo users to make a transaction, it is necessary that both sender and receiver should be available in the United States. This poses a challenge when either sender or receiver has been out of the US for any reason.

- Venmo users have a certain cap to send and receive money. This cap is there for users having Venmo debit cards, for approved apps, for in-store QR code payments.

These are just a few limitations that a payment app like Venmo has. If a competitive analysis is performed on popular apps with similar functionality, it can certainly give rise to a new app that overcomes the shortcomings of the existing system. The analysis can cover UI/UX, features, performance & technical factors, architecture, etc.

If P2P payment disruption with a unique idea is on your mind, then our team can assist you in achieving your goals. Team Daffodil, with its experience in building custom solutions for disruptive ideas, can be reached out through a free consultation session.

This no-obligation consultation can help you understand the chances of your idea causing disruption in a competitive market. Also, our team analyzes and compares your ideas to figure out the gaps (if any) and fill them. Schedule a 30-minute free consultation now!